Location:Home > News >

Google's Fiber lottery: how Google picks winners—fiber cabl

Google's Fiber lottery: Predicting who's next and how Google picks winners——Fiber Cable Manufacturer ChangGuang NEWS Digest

In a small office on the corner of a busy street, a startup CEO and her finance team are struggling to maintain a internet connection for an important video call. On the other side of the office the marketing team is creating a pitch deck using a cloud service while streaming a webinar on an iPad. The finance team and the marketing team are unaware of the trouble they are causing for one another and little do they know that their college intern is streaming Game of Thrones in the bathroom.

RECOMMENDED FOR YOU

eBook Series: Agile Operations

White Papers provided by CA Technologies

LEARN MORE

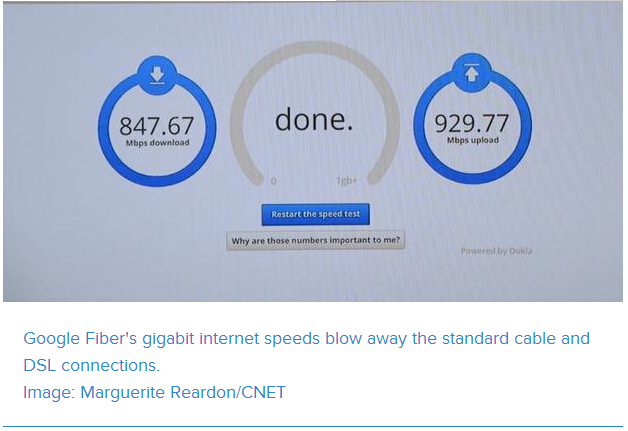

Bandwidth is a serious issue for these kinds of small businesses, as well as entrepreneurs and highly-connected families. Mobile data, streaming video, and advances in cloud services have put tremendous demands on bandwidth, and with internet service providers experimenting with bandwidth throttling and bandwidth caps, it threatens to make internet usage a constrained resource.

Google, of course, wants people and companies to use the internet like it's a unlimited resource, because as the web's largest internet advertising company, it makes more money the more everyone uses the internet.

Google Fiber is tackling this problem by putting a new face on a decades-old technology with the hopes of using it to bring gigabit internet into businesses and homes — that's over 10 times the capacity of most of today's internet connections in US homes and small businesses. No new internet product has generated as much excitement in the technology world as Google Fiber. It has piqued the interest of average consumers and left techies salivating.

When Google Fiber started in Kansas City, Kansas in 2012, it was difficult to determine how serious the search giant was about disrupting the US internet. In 2013, it expanded the experiment to Austin, Texas and Provo, Utah, and the possibility began to emerge that this was going to be a real thing. Google even released a checklist for potential Fiber cities. According to William Hahn, a principal analyst at Gartner, it's hard to tell exactly what Google is up to.

"It's like those murder mysteries. The suspect would act exactly the same way, whatever their motive, up to this point," Hahn said. "If they were trying to take a look at people's data and play in the sandbox, and were willing to subsidize for that reason, it would look a lot like them trying to spur competitive response from the CSPs."

However, in 2014, Google suddenly looked a lot more serious about Fiber when it announced plans to bring Fiber to 34 cities. That sounds a little more ambitious than it really is. It's actually only nine metro areas, but it's still a major expansion of Google's Fiber plans.

Still, it leaves every internet user in the US asking the same question — "When is Google Fiber coming to my city?"

Based on a wide range of sources from across the technology and telecom industries, we have come up with what we think is the formula Google uses to determine which cities to target for Google Fiber. Using this formula, we've also built a list of the next metro areas in line.

How Google chooses Fiber cities

So, we know that it started in Kansas City, then moved to Austin, then Provo and now Google Fiber has targeted nine more metro areas. That possibility is beginning to look more like a reality with Google recently signing a tentative franchise agreement with the city of Portland. That makes Portland the first of those nine metro areas to take the next steps toward becoming a Google Fiber city.

So, how is Google choosing these cities? Are they picking the cities who merely want it the most, or are the most prepared? According to Charlotte CIO Jeff Stovall, his city didn't really have major plans for fiber before they were approached by Google.

"It appears to me the cities that are chosen are ones that have high growth potential and are still small enough, in some respects, to be able to put in this type of infrastructure versus a mega-city like New York City," Stovall said.

We know Google is hiring for the Fiber team, with more than 60 open listings for positions such as "network infrastructure design manager." Although the listing was open in the Empire State, New Yorkers probably won't be getting Fiber anytime soon. Here are the five parameters that Google is using to determine which cities will get Google Fiber:

1. Existing fiber network - Google wants wants to move quickly and do it as cheaply as possible so it is leveraging dark fiber and existing fiber networks like the one in Provo. So far, Google has only moved to take over existing buried networks, so there is a possibility that they will install Fiber in cities that have utility poles (like Charlotte), mainly because of the massive price difference of hanging vs. buried cable.

2. Close to a Google data center - Google operates data centers internationally to support their products. More fiber running to and from the Google data centers means that it can process requests faster and glean data more efficiently. Proximity to a Google data center is key.

3. Population size range - At least in the beginning, Google will be targeting cities that are big enough to be diverse, but small enough that it will be able to avoid the oversight of cities like San Francisco, Boston, and New York City. Again, speed matters.

4. Willing local government - Permitting is, perhaps, one of the biggest obstacles that Google will have to overcome in its quest to rapidly build out Google Fiber cities. All of the city officials we have talked to said that they were very eager to work with Google, and some were working to expedite the permitting process to show their dedication to bringing Fiber to their city. So, local government cooperation is huge.

5. Not in a Verizon FiOS coverage zone - Verizon is the biggest competitor Google Fiber has at this point. FiOS consistently takes top ratings in customer satisfaction as an ISP. It would be foolish of Google to try to take on FiOS this early in the game, however, they don't seem to have a problem taking shots at AT&T, as evidenced by their brazen move into Austin.

"I think you want an underserved community that can be served economically. That might mean it has enough backbone capacity, or some way to provide that capacity, without costing a huge amount of money," said Jeff Hecht, author of Understanding Fiber Optics.

"It appears to me the cities that are chosen are ones that have high growth potential and are still small enough, in some respects, to be able to put in this type of infrastructure versus a mega-city like New York City."

JEFF STOVALL, CHARLOTTE CIO

That's why Google is targeting existing fiber networks. It saves the company time and money and it is proof that the city is interested. Provo, Portland, Phoenix, Chapel Hill, Nashville, Salt Lake City, Atlanta, San Antonio, and San Jose all have either existing fiber optic networks, or unused "dark fiber" that has been installed, but isn't currently in use.

"I believe these cities are not too big, they are not too small, they are not too rich, they are not too poor. They have the possibility to dig up the roads without causing major havoc like in downtown Manhattan, but there is purchasing power," said Dan Dieler, a principal analyst at Forrester Research.

These cities have enough resources to make good use of the Google Fiber product, without have an overbearing bureaucracy that could slow down the plan. According to Heather Burnett Gold, the president of Fiber to the Home Council in the Americas, Google is looking for cities with a committed city leadership in place who are "champions for fiber deployment," to help with things like expedited permitting, non-onerous franchise fees, access to any common ducts pole or right of way, and demand aggregation. Google is looking for cities that share their vision.

"I think Provo and Google shared a common vision about access to the Internet at home; the value to education, entrepreneurship, families and governance are all enhanced by nearly ubiquitous access and the availability of high speed said Provo chief administrative officer Wayne Parker.

The next 10 Fiber cities

Based on these five measurements from our investigation, here are 10 metro areas that we believe could be next on the list for Google Fiber:

1. Charleston, South Carolina - According to research done by others, there is a Google data center located in Goose Creek, South Carolina, which is a little over 17 miles outside of Charleston, and considered part of the Charleston Metro area. Moving into South Carolina would also offer Google the opportunity to continue its expansion into the Southeast, slowing Verizon's entry into that region. That same research points to evidence that North Carolina and South Carolina have provided tax incentives to Google in the past, proving their willingness to work with the search giant. Plus, fiber initiatives are already happening in the area, so we know there is existing fiber and a desire for gigabit internet.

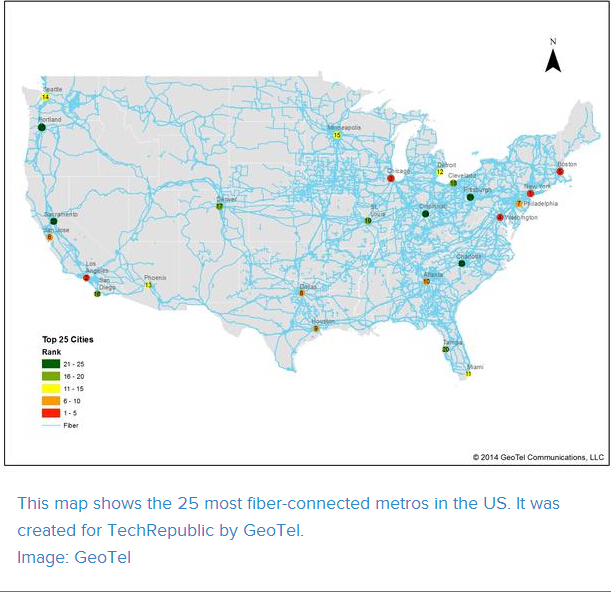

2. Miami, Florida - At present, Miami is the one of the most fiber-connected cities in the US. Verizon has cornered St. Petersburg and Sarasota, so stepping into Miami would help to sweat them a little, provided that pressuring incumbents is their overall plan. Combine that with the fact that AT&T has announced that they are planning to enter Miami and the fact that Google already has a data center there and it is a no-brainer. The demographic diversity is an added plus for Google to collect user data.

3. Houston, Texas - Texas is an important state in the geographic battle for fiber because it is a strategic link between the Southeast and the West. Google has an existing data center in Houston, and it is close enough to Austin (existing Fiber city) and San Antonio (proposed Fiber city) to glean support from those areas. It is also a proposed AT&T fiber area, and close enough to Dallas and Fort Worth (both Verizon FiOS cities) to pressure the incumbents.

4. Seattle, Washington - Seattle is almost exactly what we believe Google is looking for. Google has a data center there and it is close in distance and demographics to Portland, the most recent city to take a step toward Fiber. By getting to both Seattle and Portland, Google will effectively corner the Pacific Northwest and position itself for an easier entry into Northern California. Seattle's cost of living and focus on creative endeavors show that they have the resources and the desire to engage new technology.

"I think you want an underserved community that can be served economically. That might mean it has enough backbone capacity, or some way to provide that capacity, without costing a huge amount of money."

JEFF HECHT, AUTHOR OF UNDERSTANDING FIBER OPTICS

5. Tulsa, Oklahoma - Tulsa is a mere 45 minute drive from Google's data center in Pryor, Oklahoma. The city is home to the University of Tulsa, a private university with about 4,000 students. Verizon and AT&T have both avoided the central US, which is where Google got its start with Fiber. This gives Google a chance to draw a line in the sand and capture some of the top cities of the Great Plains region.

6. Cincinnati, Ohio - Cincinnati is one of the top 25 metros in the US with the most existing fiber. Cincinnati's population size and the presence of the University of Cincinnati offer an excellent sample population. Ohio already appears eager to get involved with the search giant, hosting a Google in Education Conference in Columbus in May of last year, sponsored by ITIP Ohio.

7. Chicago, Illinois - While this might not seem to fall in line with what the five parameters, Chicago, and its surrounding suburbs, are a testing ground for Google to enter a major city. Google does have a data center in Chicago, and the city is third most fiber-connected city in the country. Chicago's plethora of research universities adds to the potential for interesting Fiber experiments. The city's numerous suburbs could be a good starting point for Google Fiber, which can then slowly move toward the city center, if it is ever able to get the approval of the local government.

8. Minneapolis, Minnesota - Minneapolis, which is one of the most fiber-connected cities in the US, does not actually house a Google data center; but it would more than likely initially run as a support hub for the Chicago deployment. Google for Entrepreneurs has been known to sponsor events at the city's CoCo coworking space, and has named the city one of its tech hubs. If Google did decide to build a data center in the Twin Cities, the defunct Ford plant offers the perfect real estate, complete with a hydroelectric dam to win them green points. The city is known as the primary business hub in the US between Chicago and Seattle, and houses a huge number of Fortune 500 companies, such as UnitedHealth Group, Target, Best Buy, and US Bancorp. The city regularly lands on top quality of life lists and was named a "Top Tech City" by Popular Science in 2005.

9. San Diego, California - California is Google's home turf, and they are already targeting San Jose for one of their next Fiber deployments. They have a data center in Los Angeles, but Verizon has already deployed FiOS there. San Diego is the proxy Google needs to continue rolling out Fiber in California, without attacking FiOS head-on. San Diego is also a good way for Google to test the waters with the California government to see how far they can go in SoCal.

10. Denver, Colorado - Denver is another one of the most fiber-connected cities and while it doesn't have a Google data center, but it does have a connection to Google. The Google for Entrepreneurs program recently chose Denver's Galvanize startup building to be part of their network of tech hubs. Denver is a midpoint between the Midwest and the West Coast, and the Denver Technological Center is home to many large tech companies that compliment the startup scene.

Additionally, here are five metro areas to watch as Google Fiber continues its rollout. They don't meet all of our criteria, but they each offer Google a strategic advantage.

1. Virginia Beach, Virginia - While Google does have a data center in Virginia Beach, Verizon has deployed in the Virginia cities of Richmond, Petersburg, Norfolk, and Newport News; leaving Google a pawn surrounded by Queens.

2. St. Louis, Missouri - St. Louis is highly fiber-connected city, and it would provide a bridge from Chicago to Kansas City and Tulsa.

3. Columbia, South Carolina - If Google doesn't move on Charleston, they will more than likely deploy in Columbia. Google purchased nearly 500 acres in Blythewood, South Carolina, right outside of Columbia, for the construction of a data center. Columbia is also the home of the University of South Carolina.

4. Baltimore, Maryland - Baltimore would allow Google to dip its toe in the water of the Northeast, while getting them close enough to Washington, DC, which is an existing FiOS city, to put pressure on Verizon.

5. Detroit, Michigan - This may seem a little more contrived, but Detroit is one of the most fiber-connected cities in the US and is an emerging tech center. In a show of good faith, Google could deploy Fiber in Detroit to assist in a much-needed revival of the economy in the Motor City. It's also home to a Google for Entrepreneurs tech hub.

Why Fiber matters to the future

Optical fiber is essential strands of glass, about the size of human hair, that are used to transmit data. Think of the fiber like a glass-lined tube that transmits light by reflecting it internally, allowing the light to travel great distances. Many of the core concepts that made up the foundation of fiber optics were discovered in the 1800s, but fiber as a method of delivering telecommunications data didn't really emerge until the 1970s. It wasn't until the 1990s, especially around the dot-com tech bubble, major fiber installations emerged in the US.

The biggest advantage of fiber optics are their long-haul capabilities. That ability to travel long distances, combined with the data transfer speeds it offers, are what make fiber economical. Fiber optic lines are typically considered more secure, and Siemens even claims their optical fiber cables to be impervious to wiretapping.

According to Gold, and year-end estimations done by Mike Render with RVA LLC for the Fiber to the Home Council, the number of households connected to fiber in 2013 in the US was 11.9 million, that includes fiber to multiple dwelling units as well. Just fiber to the individual home was estimated at 9.8 million for 2013. According to US Census data, there are roughly 115 million households in the US. Hecht asserts that fiber is starting to get utilized because cities are tired of waiting for someone else to make it work.

"There have been a fair number of small city programs that have gone into fiber because they need bandwidth, and the cable companies aren't terribly interested in spending money," Hecht said.

It's a long-standing secret in the telecommunications industry that Google is deeply interested in fiber optics and has been for quite some time. In 2005, CNET reported that Google was interested in buying dark fiber, potentially for the purpose of building a global fiber optic network; and that the company was hiring an expert in negotiating contracts for dark fiber. Dark fiber gets its name from the fact that there is no light (data) passing through it. Unlit fiber is fiber that isn't being used to transmit data. The dot-com era saw an explosion of fiber installations, many of which remain unused to this day.

Google first rolled out the Google Fiber service to Kansas City, Kansas in 2011. The fact that Google was making a foray into fiber optics wasn't a huge shock to the IT world, but where they chose to begin their journey was. Kansas City gave Google the opportunity to experiment with fiber as a service without the oversight of a larger city. The additional support of Google's Council Bluffs data center, a mere 178 miles away, only sweetened the deal. According to Google was testing the waters.

"I think Kansas City was an experiment, and it wasn't a technical experiment," said Jim Hayes, president of The Fiber Optic Association. "I think it was more of a feasibility study to see what would happen when they tried to get deals with the local government to facilitate the construction. It was an experiment in economics. What they learned from Kansas City was that it was feasible, they would get higher sign ups than they expected, and that they could make money."

"What they learned from Kansas City was that it was feasible, they would get higher sign ups than they expected, and that they could make money."

JIM HAYES, PRESIDENT, FIBER OPTIC ASSOCIATION

Austin was next, and it was an obvious choice. The blooming startup scene and a focus on creative thinking and an entrepreneurial spirit made Austin a key strategic partner for Fiber.

Provo seemed to be more of an opportunistic play. The city deployed fiber too early, beginning the process in 1999, and they didn't have the resources to keep it up. The city initially took out a $40 million bond to pay for it. Fiber installations were massively expensive, but as is the case with most technology, the price has dropped significantly.

"They decided to build their own fiber network way too early," Hayes said. "When they installed that in '99, it probably cost 2 to 3 times as much as it would cost 10 years later."

Due to government regulations, the city could not be the internet provider, so they decided to sell the fiber network to a third party ISP called Broadweave in 2008. Broadweave eventually defaulted on the purchase and Provo was stuck with an investment that wasn't making a return. Google approached them with an offer.

"[Google said] Listen, we can buy your network but we won't have money to put into it. Or, you can sell it to us for $1 and we can help update it," said Dixon Holmes, the deputy mayor for the mayor's office of economic development in Provo.

And that's what Provo did — they sold the network to Google so they could finally realize the promise of fiber optic internet for their residents. The catch is that Provo is still paying on that $40 million bond this many years later; and, in order to fund it, each household pays $5.35 a month as part of their utility bill. It was a great opportunity for Google to build out this test group and do it economically, because, according to Hayes, "The cost of installing the cable is a lot more than the cost of the cable itself."

Why Fiber matters to Google

At this point, Google can do one of two things with Fiber — they can become a full-fledged ISP and turn Fiber into a core aspect of their business model, or they can simply leverage it to push incumbents to bring affordable gigabit internet to homes and businesses. Regardless of which road they are taking, Google stands to benefit from the outcome. They are an internet company, and faster internet means more internet usable, which is also better for Google's core business.

"They are putting a lot of time and effort into building networks if it's just for fun," Gold said.

If Google truly wants to become a world-class ISP, it could develop into a steady revenue stream to help alleviate some of the pressure on its one-legged business model. With that being said, by using Fiber to further connect its customers, Google's advertising revenue stands to benefit as well.

"They have an ambition, and why shouldn't they, to follow the connected consumer everywhere, and to be collecting data on them everywhere and organizing those offers," Hahn said. "But again, that can all go right back to the core advertising business — being able to deliver better targeted and ever more cohesive and contextually accurate advertising to consumers, to hit you with just the right offer."

Hecht said, "It's good PR, and it's good business. It's good PR because they are offering good capacity at a reasonable price. And, it's good business because they need the capacity to deliver their services."

ISPs have a notoriously low rating with consumers, and the 2013 American Consumer Satisfaction Index was the first year that any US industry has ever ranked lower than the airline industry in customer satisfaction. That industry was internet service providers, with Comcast dragging along the bottom.

"It does seem, if Google wanted to spur a competitive response from the CSPs, I would have to judge, so far, that Google Fiber has been fairly successful. But, that really just begs the question of whether Google thinks it can really be profitable for them," Hahn said.

For example, look at the Google Fiber rollout to Austin, a hub for AT&T.

If Google truly wants to become a world-class ISP, it could develop into a steady revenue stream to help alleviate some of the pressure on its one-legged business model.

"Informally, you have to suspect that that was a shot right at the heart of AT&T territory. It's really, arguably, their headquarter city. You see the response that AT&T made, rolling out a program to bring fiber in ahead of Google's schedule," Hahn said.

Google Fiber's entrance into Austin, and the legal battle that ensued, brought more attention to fiber optics and forced AT&T to move up their timeline of their fiber deployment. In fact, AT&T recently announced they plan to bring fiber networks to 100 cities, which is really only 25 metro areas but it includes Atlanta, Decatur, Charlotte, Mountain View, Nashville, San Antonio, and San Jose — all of which are among the next wave of cities targeted by Google Fiber. Even if Google isn't the one providing it, more fiber is a win for Google.

"I believe they are doing what they are doing in order to learn about high-end broadband. I think they are keen about putting pressure on traditional providers, Dieler said. Adding, "Their core focus is advertising and data analytics. I don't see them trying to compete head-on with the Comcasts of this world, or with the Verizons of this world."

Most of the cities are convinced that Google Fiber is here to stay, but that doesn't mean they want Google Fiber as the only provider of gigabit internet. Mary Beth Henry, the manager of the office for community technology in Portland said that she believes having Google Fiber in Portland will make the incumbents better, and she wants it to bring competition.

"Competition has proven to be very good for local economies, and I am hoping that's what we have here," Henry said.

Dieler said, "A key theme for me is that I'm not yet convinced that Google has this big master plan for its Fiber activities. We can't be 100% certain what Google is up to, because they themselves may not be sure where this is headed."

The ecosystem problem

Even if fiber becomes a legitimate trend that sweeps across the US and the world, the challenge is that an ecosystem has not yet developed to take advantage of it. We have access to gigabit speeds, but the compelling applications to make use of those speeds haven't materialized, in most cases.

"They have to see this entire ecosystem kick in, and that's a scale game. They've got to get everybody thinking that fiber is the only way to fly," Hahn said.

The existence of ubiquitous fiber will not usher in the next revolution of internet technologies and products, but it will provide the background for that to take place. Google often presents the potential for real-time HD teleconferencing as one of the possibilities that Fiber could bring, but the reality is that applications like that are still far off.

For example, telemedicine is often held up to show the future that gigabit internet will make possible. But, there are a ton of obstacles to overcome before it can become a reality. Not only do the patient and doctor both need to have access to a gigabit internet connection, they must both possess the right kinds of technology to make it work. And, if they can get those ducks in a row, the whole thing is still contingent on making sure the process is HIPAA compliant.

This is obviously a chicken-and-egg problem. The widespread of gigabit internet must exist before startups and major technology companies will deem it worth investing in and creating products that utilize its capabilities.

No matter what happens with Google Fiber, or any other fiber providers, the sad truth is that the best possibilities for gigabit internet are still years away. But, someone has to make an investment and take the first steps. Google looks more serious than ever about being the one to do it.

Get in Touch

+86-21-3996-3837

alex@changguangchina.com

+86-15216725374